Book Review: Devil Take the Hindmost

October 8, 2025

Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.

― Charles MacKay, Extraordinary Popular Delusions and the Madness of Crowds (1841)

Lately I've been reading the works of Edward Chancellor. In February of this year I read The Price of Time, a book about how interest rates affect the economy and the business cycle. It is essentially a critique of central banks' control of interest rates, and the economic distortions caused thereby. I also read Capital Returns, which he edited and wrote the forward to, have listened to his podcast, and read some of his articles published in Reuters and elsewhere. All of this reading combined to give me the impression of Chancellor as a staunch libertarian capitalist, so I was surprised by his first book, Devil Take the Hindmost, which seems ambivalent about capitalism, or at least capitalism's ability to rationally allocate resources.

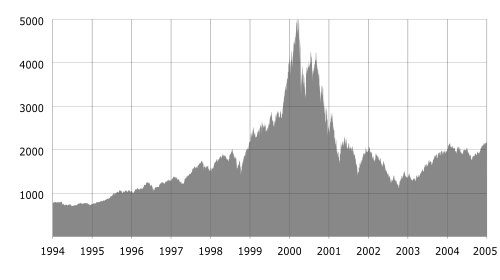

The NASDAQ index from 1994-2004, showing the dot-com bubble.

The surprising message of the book is that speculative bubbles are an inherent feature of capitalism. As soon as trade began to become sophisticated, in the Netherlands and London in the 1600s, speculation ran amok, leaving value destruction and suffering it its wake. From the Dutch tulip bubble to today, bubbles form, pop, and reform.

Chancellor also documents how economists have tried to discredit or downplay past episodes of speculation in service of the “effecient markets hypothesis”–the idea that capital is allocated rationally in a market economy. Chancellor uses endless examples of stock market manipulation and speculative bubbles to show that this just isn’t so. He persuades us that the valuations of stocks at any given time are as much a sociological phenomenon as anything rational. The collective consciousness of the market is subject to extraordinary mood swings, prices rise when the market feels greedy, confident and euphoric, and fall when it feels fearful and pessimistic.

I’ve become a little bit obsessed with speculation and stock market bubbles. As a software developer, I’ve had a front row seat to the AI bubble. Reading this book has helped me to keep my sanity during what I see as a deeply irrational optimism about LLMs and their profit-making potential. There is nothing new under the sun. Since the beginning of capitalism, new technology has inspired speculation. While the euphoria is high, nobody wants to look soberly at the facts. When the music stops, we will all wonder how we could have been so foolish.